March 28, 2023

Using Airline Incidental Credits

Pam

One of the benefits of several credit cards is an airline incidental credit. These are usually offered on the cards with higher annual fees, so you want to use these benefits to make the annual fee seem lower. Using credit card airline incidental credits can be tricky because most of the things you can use it on don’t cost a lot. The following cards have an annual incidental credit:

- American Express Platinum – $200 credit

- American Express Business Platinum- $200 credit

- Hilton Honors American Express Aspire Card – $250 credit

- Chase Ritz-Carlton (no longer available for new applications but available as a product change) – $300 credit

You need to pick one airline to use this credit with each card. This airline can be changed yearly, usually during the month of January, to use that year. You can access the airline selection screen by scrolling to your online account’s “Benefits” section.

These are the airlines you can pick from:

- Alaska Airlines

- American Airlines

- Delta Airlines

- Hawaiian Airlines

- JetBlue Airways

- Southwest Airlines

- Spirit Airlines

- United Airlines

The credit is intended for baggage fees, booking fees, in-flight food, and lounge admissions. With the Ritz-Carlton card, you can also use it for seat upgrades. Let’s talk about some less obvious and even better ways to use them. Warning: these are unauthorized uses, so proceed at your own risk, but they have worked for me!

TravelBank with United Airlines

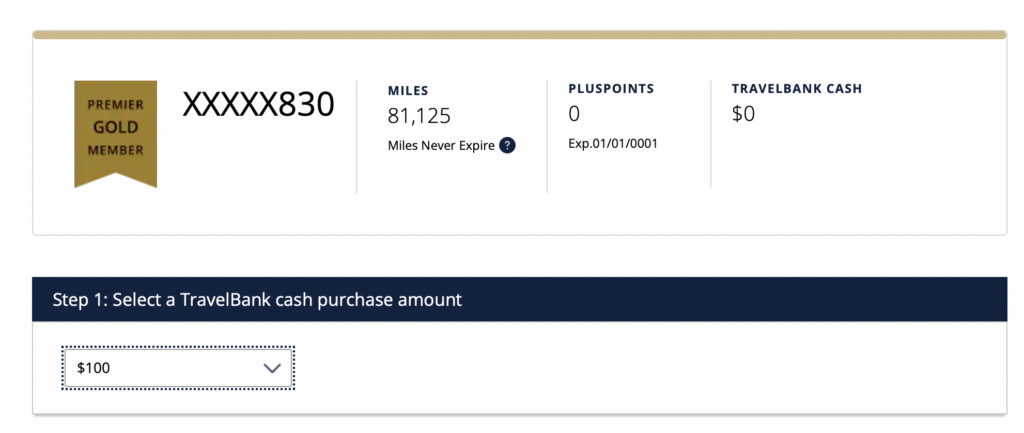

This is how I use all of my incidental airline credits. I pick United as my airline of choice each year. You can reach the TravelBank area here. It looks like this:

When I press the purple button to fund my TravelBank account, I can buy two $100 certificates and use my card that offers this credit. I end up with a $200 credit to use on United and the credit appears on my credit card statement.

Booking Southwest Flights for Less than $100

Another option if you select Southwest as your airline is to book flights for less than $100. This should trigger the credit. The key is to make sure the flight is under $100. Don’t have a flight you want to take that’s under $100? No problem. Book any flight you find under $100, and then you can cancel it to get a future flight credit to use later on. This is how Alex uses her $200 airline credit and what I used to do before my United TravelBank days.

5 days after purchasing the flight, the credit showed up in her account

Covering Airline Taxes/Fees

Every flight has some sort of taxes/fees from $5.60 for one-way domestic flights to hundreds of dollars on international flights. It may vary by airline but typically your AMEX flight credit will work to cover these fees. I have particularly seen success with Southwest. Remember, this will only work for your designated airline.

Bottom Line

Using credit card airline incidental credits is something I make sure I always do so that my annual fees seem to cost less. Since I use the United TravelBank feature, I do this at the start of the year and don’t have to think about doing it again. How do you use your airline incidental credits?

Leave a Reply

Affiliate Disclosure: Travel Mom Squad uses affiliate links. We may receive compensation if you use our links when applying for a credit card at no extra cost to you. This compensation does not impact how or where products appear on this site. We have not reviewed all available credit card offers on this site. Thank you so much if you use our links!

Editorial Note: The editorial content on this site is not provided by credit card issuer. All opinions, reviews, and recommendations are expressed by the author, not the credit card issuer.

Have you used UA Travel Bank for Ritz Card incidentals?

Personally, I haven’t. I watched a YouTube video that said it would work but I have no data points to support it. I’ll try next year because I’ve already used mine for a first-class domestic upgrade.

I had no idea I could fund my United TravelBank with my Amex platinum $200 incidental airline credits! So easy to do and now I don’t have to worry about trying to use them anymore. Thanks Pam!

Glad to help!

That is a hard airline to use those incidental credits. If you don’t plan to travel with them, there isn’t much you can do. Definitely, change to United.

For booking a Southwest flight under $100 and then canceling it to get a future flight credit to use later on… can it be Wanna Get Away rate or does it have to be something else specific?

It can be any fare but I would try and get one about $49 – those have always worked for me.