January 13, 2023

Paying Taxes with a Credit Card

Pam

Last year we paid our federal taxes by credit card. Is it worth paying your taxes with a credit card? My husband is self-employed, and we had a tax bill of about $30,000. I hate writing a check for taxes and getting nothing back. Taxes are hard enough to pay anyway, right? I decided I would try to get points for it last year. Let’s see if my efforts were worth it. Note: credit card offers were correct at the time of publishing this post but may have changed.

Credit Cards

You can use two credit cards to pay your tax bill so I picked ones with a big minimum spend. We each opened The Business Platinum Card® from American Express.

The offer at the time was 110,000 American Express Membership Rewards® per person after a $15,000 minimum spend. I also referred him from mine and got an additional 35,000 American Express Membership Rewards®.

These have a high annual fee of $695, but I could offset $200 of each with airline travel incidentals and another $400 with Dell credits. The Dell credits are $200 every 6 months. That brought the annual fee to $95 and included Global Airport Lounge Access. I love a good airport lounge, and my hubby is now a convert to them too. It also comes with a $189 CLEAR credit.

I got 1.5x the points on my tax spending, so 45,000 points, 35,000 for the referral, and 220,000 for the welcome offers.

Total points earned: 300,000 American Express Membership Rewards®

All information about The Business Platinum Card® from American Express has been collected independently by Travel Mom Squad. The Business Platinum Card® from American Express is no longer available through Travel Mom Squad.

How to Pay Taxes

The IRS details sites that you can use to pay your taxes with a credit card. At the time that I paid them, there were these three sites that you could use.

I chose PayUSATax and split my payment between both cards. My service fee was $294 for each payment, so $588 total.

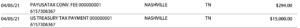

My bank statement from my 2021 tax year payment

Doing the Math

I spent $588 on fees and received 300,000 in American Express Membership Rewards® . Most people value Membership Rewards at 2 cents apiece. I will use them for business class seats so that they will be worth more than that. But just at 2 cents apiece, my 300,000 Membership Rewards are worth $6,000. Definitely, worth those fees I had to pay!

Most business class seats are about 70,000 points/miles each way. I can easily get at least 4 seats with my points. These could each be valued at $4,000+, so definitely worth paying my taxes by credit card! I will be doing this every year!

I can fly to and from Florence in business class with part of my miles earned paying my taxes!

Alex’s Experience Paying With an Ink Card

I just paid my quarterly estimated taxes. My husband just opened a card_name, and the plan was to hit the whole minimum spend amount by paying that estimated tax. I went to do that last night, and I got an error message saying they couldn’t accept my card. I tried both payUSAtax and Pay1040 and got that error message. I didn’t try ACI. I did some research and found out this has been happening recently with the Ink cards.

Instead, I added the Ink card to my PayPal account and then used PayPal as my payment method and made sure my Ink card was the payment method for PayPal. I used Pay1040, and it worked perfectly.

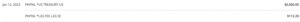

The pending payment on my husband’s Chase account

We haven’t heard of any other cards having issues. If you encounter any problems, use PayPal; it should work great!

Bottom Line

Paying taxes is NOT fun! If you can get a bonus in points/miles, it takes a little bit of the sting out of it. I will continue to get a new credit card to pay my income taxes in the future, as I found great value in it!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

I’m new as of yesterday and my mind is racing and overwhelmed but know this is par for the course! This particular blog is huge for me considering I paid $46k in taxes last year as a small business owner! I’m wondering if it’s worth doing the kids college bills as well. I’ve not used a card as there are fees attached but it’s going to be doing the math to see if it works.

When you are meeting minimum spend an getting a big bunch of points it IS always worth it in my book. You can see that the math played out in this post. It may not work if you are just using a card you already have and only getting points for that spend. That is why I always open a new card or two whenever I have to pay taxes. I would do the same with my kids college bills – get that new card then.

Newbie here! I’m so appreciating all of your content! I’d hoped to pay my taxes with my new Chase Ink card and like Alex, was planning to hit the whole minimum spend doing so. But I was surprised to find the credit limit was only 3K, which won’t cover my taxes (or meet the minimum spend of that card in one fell swoop). Am I missing an obvious way around this? Thank you!

Newbie here! I’m so appreciating all of your content! I’d hoped to pay my taxes with my new Chase Ink card and like Alex, was planning to hit the whole minimum spend doing so. But I was surprised the credit limit was only 3K, which won’t be enough to cover my taxes (or meet the minimum spend of that card in one fell swoop). Is there an obvious way around this that I am missing? Thanks!

I would pay $3000 and then pay off your credit card and pay another $3000. I paid mine with two different credit cards and had to go into the site again this way.

Thank you for replying! I didn’t realize this was possible. Final question, promise. Do you mean that you can do this within minutes? As in, I can pay a purchase up to the credit limit, then go to the credit card website and pay that off, then go back to the purchase website and finish paying, even when the payment is still pending on the credit card? Truly, thanks again so much.

You will need to wait until it has posted as a credit – that may take a day or two.

Thank you for this post! I was able to meet minimum spend on my husband’s and my new cards by paying our taxes – at least this way we can enjoy a couple of free nights with our kids in Orlando.

Awesome – it’s so nice to get something nice for paying taxes!

My husband has been self employed for years but, because we have several children, our tax liability is low or even zero. Is it possible to go ahead a pay a quarterly tax payment each quarter knowing that at the end of the year we would have paid in too much and just wait for the refund ( but still get to put money on a cc)?

Whoah, I am not a tax specialist so have no idea on this! Anyone?

Do you also pay estimated taxes each quarter? Can you tell me the best way to set this up if I can pay with my cc?

Yes, I do pay estimated taxes each quarter with credit cards. You can use up to two a quarter so that is nice. I just go to the IRS site and choose “Make a Payment”, then pick pay with a credit card (often using two). It’s super easy – I don’t mail those slips in that you get from an accountant.

Love all this info!! Thank you so much!!

Jess, what is the Dell credit you were referring to that off set your annual fee for Amex?

Thank you SO much!

The Dell credit is for the American Express Business Platinum card. Look at the benefits section, you have to enroll first.