December 19, 2022

How to Earn Travel Points

Alex

We love credit card points and miles! Without them, we wouldn’t be staying at fancy hotels in Maui, flying business class to Greece, or going on nearly free vacations to Thailand. Before you can redeem your points for free flights and hotel nights, you have to earn them. Today we are going to talk all about how to earn travel points!

Signup Bonuses

Credit card signup bonuses are the best way to quickly earn a big chunk of travel points. This is what a signup bonus could look like, open a credit card and spend $3,000 in 3 months and the issuer will give you 50,000 points. Those 50,000 points are the signup bonus. A signup bonus is a way for credit card companies to reel you in and incentivize you to try their cards. Their hope is that you’ll open one of their cards, put a lot of spending on it, and not make your monthly payments. But that’s not gonna happen!

Periodically, credit card issues will increase the bonus on their card for a limited time. When possible, we like to take advantage of those limited-time bonuses. We keep a list of all the current limited-time bonuses.

Earning the signup bonus on the World of Hyatt card helped us get 2 free nights at the Grand Hyatt Kauai.

Shopping Portals

Another way you can earn travel points is by using shopping portals when you shop online. A shopping portal is a site that awards you points (or cashback) for shopping through their site vs. starting directly at the merchant.

Most US Airlines have their own shopping portal that will earn you miles when you shop through them. They all work basically the same way. You’ll need to have a loyalty number with the airline to get started. The Southwest Airlines shopping portal is nice because the points you earn will go towards earning you the Southwest Companion Pass. When it comes to hotels, most do not have shopping portals. The only ones that do are Wyndham and Choice Privileges. With these portals, you don’t need to have or use an airline credit card; you can use whatever card you’d like.

If you want to earn Chase Ultimate Rewards, then you’ll want to check out their shopping portal. You’ll log into your account and select earn bonus points from the main menu to access it. From there, you can search for your store. In the terms and conditions, Chase says your need to use your Chase Ultimate Rewards card to get the shopping portal bonus points.

If you are after American Express Membership Rewards, you’ll want to check out Rakuten. Rakuten is a cashback portal, but you can link your Amex account and earn membership rewards instead! Rakuten and the Chase Ultimate Rewards portal are my go-to’s.

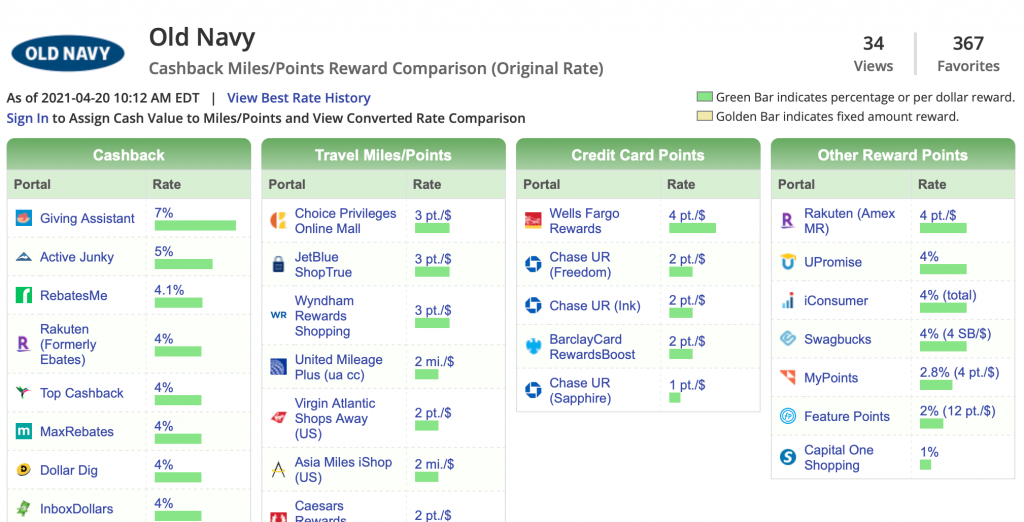

There are many others as well, but those are the most common. I like to check Cash Back Monitor to see what portals offer the best bonus when I’m ready to purchase.

Cashback Monitor shows me all the payouts currently going on when I shop Old Navy online. I don’t use 95% of those. I would use Rakuten in this instance.

Referrals

How else can you earn travel points? You can refer your friends and family to the cards you already have! Not only will you earn referral points, but they’ll also earn a signup bonus! Already referred your partner? Tell your family and friends all about credit card points and miles and ask them to use your links! Referral links will usually earn you between 5,000-20,000 points, depending on the card. This is a great way to give yourself a points boost.

Need help finding your referral link? To generate your referral link from a Chase card, click here. If you have an Amex card, click here.

Stay at Hotels and Take Flights

This is the old-school way to earn travel points. It can take a long time to earn enough points for free hotel nights and flights, but each little bit counts! You won’t earn points on stays or flights that you use miles on, but you do on cash-paid flights and nights. If you travel a lot for work, all that business travel can really add up a lot quicker!

Use Your Credit Card

Using your travel reward credit card is another way to earn more points. I never use cash. Each dollar spent on a credit card adds up!

Bonus Category Spending

You can earn more points on your credit card by knowing the bonus categories on your cards and using the right cards for the right purchase. For example, the Amex Gold Card earns 4x the points at restaurants and grocery stores, so I would use that card for those purchases instead of a card that just earns 1x the points.

Another card I love is the Chase Freedom Flex. This card earns 5x the points in categories that rotate each quarter. The 5x points are good on the first $1,500, so if I max this out, I will earn 7,500 Ultimate Rewards this quarter. Remember, you must log into your Chase account each quarter and activate this offer.

Take Advantage of Promos

Airlines and hotels offer lots of promotions during the year. Hyatt does what they call the World of Hyatt Bonus Journeys.

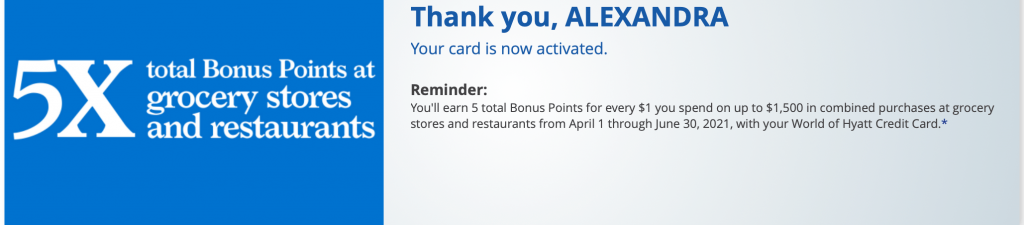

Sometimes promos and offers are targeted, meaning they aren’t open to everyone. For example, Chase co-branded credit cards like Hyatt, Southwest, IHG, and Marriott often offer bonus points on spending. Below is an example of a targeted offer I had in the past. Check out this link to check if you are eligible for an offer. Make sure to check this at the beginning of each quarter.

A past promo on my Hyatt card

Last year there was a promo on my Amex Marriott card for 10x the points at gas stations. These promos come and go, and oftentimes (but not always), you will get an email from the credit card issuer letting you know about the promo.

Retention Offers

You can sometimes earn travel points through retention offers. A retention offer is when the card issuer waives or reduces your annual fee or gives you points to get you to reconsider canceling your credit card and retain you as their customer. Recently, my mom went to cancel her Delta Amex Platinum card and was offered a discount on her annual fee, plus a stash of Delta Skymiles in order to keep it for another year. Retention offers aren’t always available, but they are worth checking out before you cancel a card.

Buying Groups

Buying groups is not only a great way to hit the minimum spend but also a nice way to earn some extra points. A buying group works by asking people to buy hot ticket items and shipping them directly to them. After receiving the item, the buying group will pay you back. They then resell it for a profit. Sometimes they’ll even pay you more than the retail price, so you come out ahead. This can be even better if you are able to shop through a shopping portal. This benefits the points and miles community because it allows you to spend some money and earn some points but not really have to pay for it.

Buying groups aren’t for everyone. If you are going to get into this, then make sure you are organized, buy from the right store, double-check that the payout isn’t less than what the item is retailing for, and double-check everything, so you don’t make a costly error. I’ve found Buy For Me Retail to be a good buying group to start with.

Bottom Line

While credit card signup bonuses are the easiest and quickest way to earn a stash of points, there are many other great ways to earn points. Not all of these things will resonate with everyone, but hopefully, there is something in there to help you increase your points balance faster. When it comes down to it, though, don’t stress. Some points are better than no points! You can exhaust yourself chasing after every single point. Get what you can, and then enjoy them!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.