August 8, 2023

How to Convince Your Spouse That Credit Card Points and Miles Are Worth it

Alex

Do you have a spouse, partner, family member, or friend who is less than thrilled with your newfound interest in credit card points and miles? If so, this post is for you! Today, we are going to share some tips that will help you ease some of the concerns and skepticism your spouse (or other travel companion) may have regarding getting into the points and miles game. These tips and tricks will help you gradually convince them that this is a worthwhile hobby. You can hear us talk about this subject on our podcast (episode #36), which includes our husbands and their thoughts from when we said we were going to use credit card points for nearly free travels.

Do Your Homework

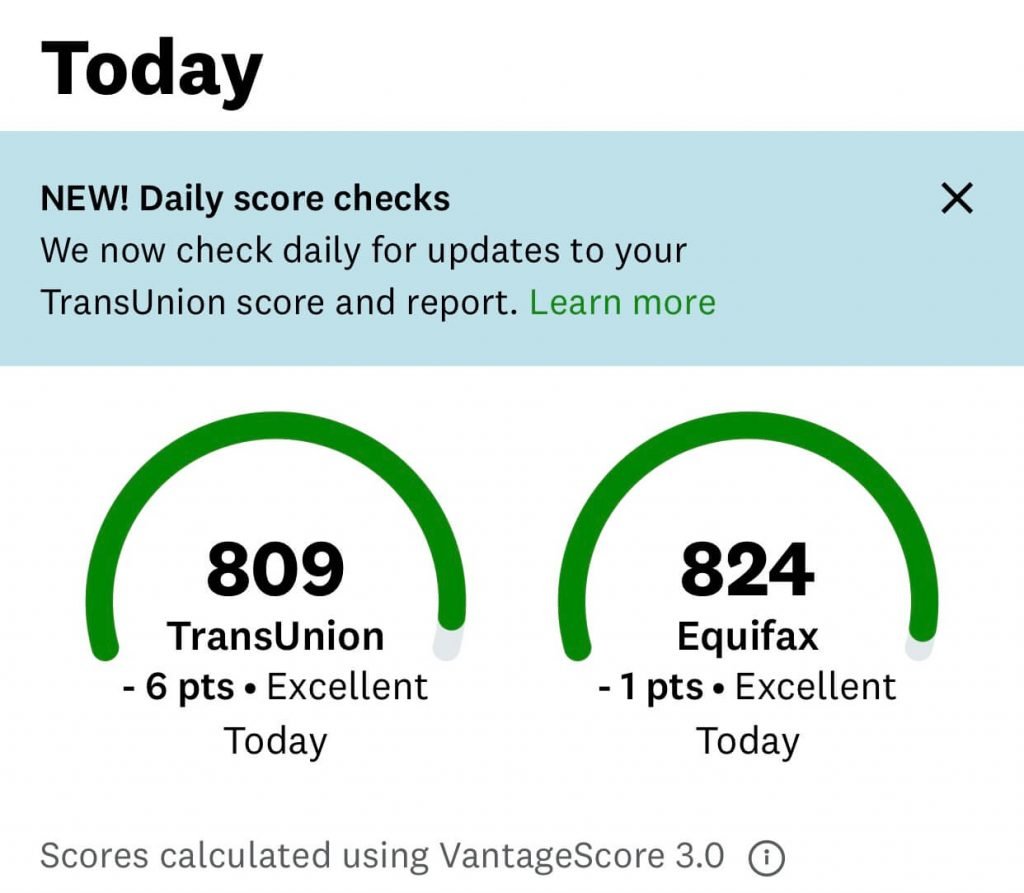

When I approached my husband about traveling with points, he was actually interested, but said that if I wanted to start doing this, I needed to read up on it. That was such great advice that I am now passing it on to you! If you want your spouse to be on board, then ensure you’ve done your homework and understand how credit card points and miles work. Our blog is full of information! Make sure you read our beginner’s guide and pay special attention to how this impacts your credit score. If you have a spouse who is unsure about this, it is probably largely due to how they imagine this will impact your credit score. When you come in confident and have a good understanding of how this works, you increase the chances of your spouse really taking you seriously. You should also read our start here section.

Watch Your Spending

Some spouses and partners are leery of their significant other breaking into this hobby because they worry that they will overspend or get into credit card debt. If you have a history of credit card debt, then you will have a tough sell. If you are currently in credit card debt, then now isn’t the right time to get into credit card points and miles. This could take some time. The only way to convince your partner that this won’t be an issue is to ensure it isn’t an issue!

Start in Single Player Mode

I’ve heard of people whose spouse wasn’t on board with opening up credit cards for travel points, but it was fine if the other person decided to do it. If you find yourself in this position, then that’s great! There are so many great cards you can get by yourself. The best way to convince your spouse to join you and become your player two is to show through your success what points and miles can do. Take him/her on nearly free vacations, and show them how your credit score is great, maybe even better than when you started.

Start Small

Another way to get your spouse on board with the points and miles game is to start small. Get one card, and understand that one program really well. Pay off your card in full each month, and show that you are responsible and have a handle on this. Once you have done that, see how they feel about letting you refer them to that same card or you getting another card. Start small and take it slow so they can get comfortable with this whole thing.

Even just starting small with one card can get you free hotel nights in Hawaii.

Take Them on a Trip

This might be the best way to convince your spouse to join you in collecting credit card points and miles. My dad didn’t really get the whole idea of my mom opening up all these cards. He was fine with it and didn’t mind being player two, but he did think it was a pain if he ever had to call the banks. Then my mom took him on a business class flight on Emirates to Dubai. He was amazed that they could each take a $7,000 flight and only pay taxes and fees. After that, he was on board! My dad has become a big fan of airport lounges as well and has grown quite accustomed to the lifestyle that points and miles have provided!

My dad was on board after getting to fly like this for next to nothing

Make it Easy For Them

If your spouse thinks this will be a lot of work for them, assure them it won’t be! Take on the responsibility of being over the points and miles for your household. Tell them what card to apply for, have access to the accounts and pay them all off, keep everything organized, and hand them the card you want them to use. Basically, all you need from them is to apply for cards to get double the points. Take on the rest, and that will help them to be more on board.

Bottom Line

Having a player 2 in this game with you really increases the number of points you can earn. If your spouse isn’t on board with points and miles, give them some time. Hopefully they’ll come around, especially once they see how successful it is for you!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

I “helped” my husband sign up for his Chase Saphire account as my P2. I did it using my own email address. Just got his card in the mail. How do I get him set up? With my email and a different account? Or somehow switch to his email? Help, please!! He’s fine with whatever as long as I handle it. Sorry if I posted this already!

I would probably call Chase to add his email to the account unless you see both in your Chase account and can switch it there. You would want him to see his in his own account. Call Chase and have him say it is okay for you to handle the talking and just explain you are the “household secretary” and want his account separate.