October 18, 2023

How to Meet Credit Card Minimum Spend

Pam

Do you love the idea of nearly free travel but are afraid you can’t meet that minimum credit card spend of $2,000 -$5,000 to earn the welcome offer? I am here to show you how to meet the minimum spend on credit cards. It is simpler than you think! And you can listen to more thoughts about it in Episode 19 of Points Talk with the Travel Mom Squad!

Obtaining the welcome offer after meeting the minimum spend on a new credit card is what we are all about. Nothing beats getting 40,000-100,000+ points just for opening a new credit card and using it to pay for daily expenses or for a big purchase item you may have coming up.

Sometimes, people want to open a credit card to get the welcome offer but worry that they can’t spend $2,000 or more in three months. It is easier than you might think. Think of the items you pay for monthly:

- Groceries, dining out, entertainment

- Cell phone

- Utilities

- Internet and cable

- Car insurance

- Gas

- Memberships and subscriptions

- Medical expenses

- Gifts

- Prepay for upcoming travel plans

- Business expenses

- Income taxes, property taxes

Groceries, Dining, Entertainment

I used to use a debit card every time I bought groceries, particularly if it was for a small amount. I now use a credit card for every grocery purchase. Always use that card when trying to meet the minimum spend on a card. Groceries are a huge part of every family’s monthly expenses. Using a credit card to purchase ALL your groceries will aid you in meeting minimum credit card spend to earn your bonus points.

When I dine out and am not trying to meet the minimum spend on a credit card, I always use my American Express® Gold Card. It offers 4 points per dollar spent at restaurants worldwide (on up to $50K in purchases per calendar year), which is a great way to get more points on daily spending.

Meeting minimum credit card spending can be done by paying for your groceries!

Phone Bills, Utilities, Internet, and Cable

You should always pay these bills by credit card. Sometimes, when trying to meet credit card minimum spend, paying a month or two ahead on these bills even makes sense. Most companies don’t charge extra to pay by credit card, so you might as well earn points. You can even offer to pay your friend or relative’s phone bill! Just have them Venmo you the money later.

Insurance

Sadly, paying insurance bills is a necessary evil, but at least we can get some compensation by using a credit card to pay our auto, home, and renter’s insurance. When trying to meet minimum spend, paying a year in advance may be worthwhile.

Gas and Other Car Maintenance Bills

Even though our family has only two drivers, we still spend a lot on fuel. We also pay for oil changes, parking at the airport, detailing our cars, tires, car registration, and repairs. When you are trying to meet the minimum spend on your credit card, it may be time to get those new tires you know you need.

Memberships and Subscriptions

Do you belong to a gym? Do you use Netflix? Do you belong to Amazon Prime? All of your memberships and subscriptions can be paid by credit card. It may be a bit of a hassle to change out all of your payments to whatever credit card you are trying to use to meet the minimum spend, but it feels worth it when you are sitting on that plane traveling on your nearly free vacation!

Medical Expenses

If you know that you will be having surgery, having a baby, getting dental work done, or any other medical procedure, consider getting a new card around that time. It will take the sting out of paying so much when you know it will go towards a free trip!

Gifts

We all have to buy gifts throughout the year anyway, so why not put them on our credit cards? Now might even be the time to finally do your Christmas shopping early when you are trying to meet credit card minimum spending.

Buy Christmas gifts early to help meet the minimum credit card spending!

Prepay Travel

Most people travel at least once a year, many more often. Although I travel a lot with points, I can’t/don’t use points for some things. When trying to meet the minimum spend on a credit card, I try to prepay what I can. For instance, if I fly domestically, I’ll buy my flight then. I prepay my timeshare maintenance fees. I also pay for tours I have planned to go on while at a destination.

Business Expenses

Do you have a business? Does your spouse have a business? If so, it’s great to pay those expenses with your card if you can and get reimbursed. My husband is a consultant and often has to travel, stay at a hotel, and eat out. We tell the company he works for that we will pay the expenses, and they reimburse us monthly. This, in itself, can often meet our minimum spend.

Pay Taxes

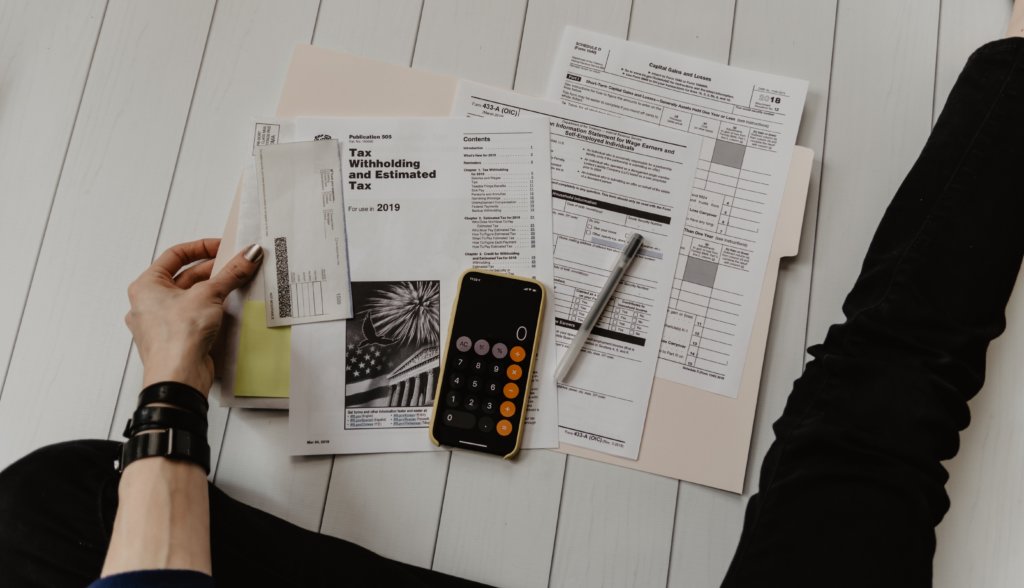

Sometimes, paying your property or income taxes with a credit card makes sense. You will have to pay a fee, but that fee may be offset by the bonus you are getting. As a business owner, I do this several times yearly to pay my quarterly estimated taxes. Even if you’re not a business owner, you may be able to lower your withholdings on your W-2 and pay estimated taxes to get those bonus points!

I meet the minimum spend on a couple of cards each year by paying my taxes with them!

Big Purchases

A great time to open up a new card is when you have a big purchase coming up. If you are planning to buy a new washer and dryer, why not meet the minimum credit card spending requirement simultaneously? Open a new card, buy the appliances, and pay the bill. That is a great way to reach the minimum spend fast!

Pick Up the Tab

One way to help meet a minimum spend is to offer to pay expenses for others on your card and get reimbursed. I love picking up the restaurant tab on my credit card and having people reimburse me in cash or Venmo. Anytime something needs to be purchased for a school, church, or other group functions, I always offer to be the one to purchase whatever we need! Everyone will pay me back, and I get the points—more points are a win for me!

Meet your minimum spend by paying bills on your credit card and having people Venmo their share to you!

Word of Caution

Keep track of what you are putting on your card. Pay it off weekly if you need to. The goal of all this is NOT to get in debt but to earn points for everyday spend. You should not be surprised by what you’ve put on a card at the end of the month. Most importantly, never spend more than you can pay off each month! Use your credit card as a debit card.

Chances are you are already paying $1,000 a month or more on these items. You need to make sure you are paying with the credit card you are using to meet the minimum spend at the moment. I literally almost NEVER use cash or a debit card to pay for anything—it’s leaving points on the table! I will use a credit card to pay for EVERYTHING, even a $5.00 purchase, because it all adds up!

How I Meet Minimum Spend Every Month

Groceries $600

Cell phone $120

Utilities $200

Dining out $100

Car insurance $200

Gas for two cars $300

Pest control $90

Internet $60

Direct TV $110

That’s $1780 a month, and I haven’t even put down gifts, clothes, and miscellaneous things that always creep up. Here are some ideas on how I met a bigger tax spend. You will be surprised at how easy it is to meet a minimum spend the longer you are on your points and miles journey!

Bottom Line

Don’t let minimum spend on a credit card scare you away. Get a paper and pen, write down all your expenses, and figure out how to pay for them with your new credit card. While you’re at it with that pen and paper, start planning how you will use all those new bonus points! Before you know it, you will have a stash of points! And then, get ready and sign up for another card! With a plan, meeting credit card minimum spend is totally doable!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Hello,

I have just started following your podcast and I am on your email list. I received your email yesterday “Last Call for Two Best Ever Offers! “ I applied for my first business card and was approved. But the promotion is only 75k points. Did that promotion change yesterday?

Thank you

Leslie

Sometimes the bank will end it sooner than they say – call them and ask to be matched to the 90K offer – it often works!

We only pay a fee when we are trying to meet minimum spend on a card. Getting that big hunk of points is almost always worth the fee.

Thanks for these tips! I don’t think the minimum spend checklist is working for me? Is the link still active? Thanks!