October 27, 2022

Credit Card Application Rules

Pam

Credit card application rules vary by bank. Knowing the different rules increases your odds of approval when you apply for a card and helps you decide which card to apply for next. This is one of those not “too exciting” posts that is important to look at when you want to apply for a new card. Here are some of the rules for various banks.

Chase Credit Card Application Rules

While we love Chase credit cards, particularly ones that earn Ultimate Rewards, they can be stricter with instant approvals. If you don’t get instant approval and haven’t heard from them for a couple of weeks, or if you get a denial, call their reconsideration line at 1-888-270-2127. Often, they just need more information, or credit limits need to be reduced from one card and transferred to your new potential card. At the very least, you can learn what you must do to get approval when applying again.

Chase 5/24 Rule

This is the big and most important rule of all credit card application rules. It affects all your credit card applications for all cards. Chase will only approve you for one of their credit cards if you have had fewer than 5 credit card approvals in the last 24 months. This is from all issuers, not just Chase.

Let’s say you have 3 Chase credit cards, one AMEX card, and one Target card, and you received all of them in the last 24 months. You want another Chase credit card and would like to apply. Don’t bother. You will not be approved based on this rule. You will have to wait until one of those credit cards passes the 24-month mark since you were approved for it.

Because of this rule, we encourage you to get those Chase credit cards that interest you first. You can always get the others later. The nice thing is that most business credit cards do not apply to this rule, so if you are at the 4/24 mark, you can get some business cards and not go over 5/24. Discover, TD Bank and most Capital One business cards DO count towards your 5/24 status. However, the Capital One Venture X business card DOES NOT count towards 5/24 status.

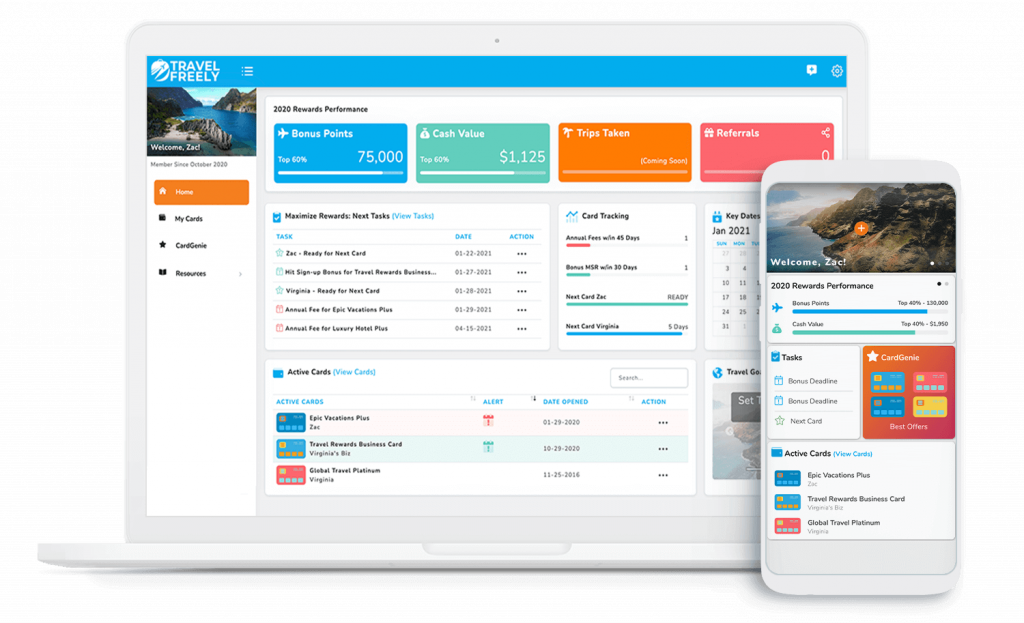

We highly encourage you to use the Travel Freely app. It will help you keep track of your 5/24 status.

Travel Freely website and mobile app will help you keep track of your 5/24 status.

Rules about Reapplication of Cards

Generally, you can receive the bonus on one of their cards again when it has been 24 months since you last received that bonus and you no longer have the card. For instance, you received a Chase Southwest® personal credit card bonus in May of 2019. You would be eligible to apply for that card again and receive another bonus in May of 2021 if you have canceled the card.

This 24-month rule does not apply to the Chase Sapphire cards, though. In these instances, you have to wait 48 months. Remember that it is the time between receiving the bonus, not the time between applications.

Generally, you cannot apply for more than 2 Chase cards in a 30-day period.

Rules Within the Family of Cards

There are specific rules within each “family” of cards also. These include:

- You can’t simultaneously have the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve®.

- You can only have one Chase Southwest personal card, but you can have two Chase Southwest business cards.

- You can’t have a Chase Marriott credit card if you have an American Express Marriott credit card.

- You can’t have both Chase Marriott personal cards at the same time.

Chase Ink Business Credit Cards

This is where it gets good. You can hold all three of these cards at the same time. However, you can only apply for a Chase business card once every 30 days. This is an easy rule as the minimum spend is higher than on personal cards. You may get approved for multiple cards if you have more than one business.

American Express Credit Card Application Rules

American Express has some fantastic credit cards, and once you have received welcome offers on the Chase credit cards that interest you, they are a great program to join. They have co-branded cards and credit cards that earn transferable points, such as American Express Membership Rewards®. We love transferable points because of their versatility. Want to use them for flights? You can. Want to use them for hotels? That works, too. Each card issuer has different rules regarding their credit cards.

American Express Family Language

We used to be able to open AMEX cards in any order we desired. However, there is now “family language” that states you may not get on one card if you have another. Simply put, you need to open them in a specific order now if you want to get welcome offers from all of them. Read more about this here. At this point, this applies only to the personal cards.

If I get this card first, the AMEX family language will prohibit me from getting the green and gold personal cards later.

American Express Lifetime Rule

I love my American Express credit cards, particularly The Platinum Card® from American Express, but I wouldn’t say I like their lifetime rule. This rule states that you can only receive a welcome offer or bonus on each of their cards once in a lifetime.

For this reason, you want to sign up when a credit card offers a high welcome bonus. This rule includes transferable point credit cards like the American Express® Gold Card and co-branded cards like the American Express Marriott Bonvoy cards. There are reports that after about seven years, you can apply again. I guess it’s a short-lifetime rule!

Occasionally, you may receive an offer for a credit card that does not have its lifetime rule on it. In this case, you can apply again. I have personally been able to apply for the The Business Platinum Card® from American Express three times for the same business and received bonuses each time. This is definitely the exception, but you may see it at times. I have also gotten the Delta SkyMiles® Gold American Express Card twice, as the second offer did not have a lifetime rule attached to it.

Number of Cards

American Express restricts the number of credit cards you can have with them to five. Credit cards should not be confused with their charge cards, though. Charge cards offer Membership Rewards, don’t have preset spending limits, and include their Platinum credit cards, Gold credit cards, and Green credit cards, both personal and business ones. You can have up to 10 of their charge cards.

I currently have seven of their charge cards and four credit cards. I would like to get the American Express Hilton Aspire Credit Card, which should be approved according to their rules. I also find their cards easy to approve unless you are in “pop-up jail.”

Pop-up Jail

Luckily I have never had this problem but Alex and Jess both have. Pop-up jail is when you try to apply for an American Express credit card, and a pop-up shows up that says if you continue with the application, you will not get the bonus. This is often given because you have too many of their cards or are not using the cards you have. For Alex, it was because she was not using the credit card from American Express she already had. She took it out of her proverbial sock drawer and has been using it regularly, and she was recently able to get out of pop-up jail.

Clawbacks

American Express is very strict about not applying for a card, receiving a bonus, or canceling a card. If you do this, they will take back your bonus or “claw it back.” It is important to wait until the annual fee posts in the second year before you cancel the card. You will not have to pay the fee for the second year. Just let it post, and once you cancel or downgrade it (within 30 days), they will refund the fee.

Recently, I decided to cancel my American Express® Green Card because I was not using it and didn’t want to pay the annual fee. I thought it had been a year since I applied for it, but I didn’t double-check. I got on a chat and said that I was going to cancel. No retention offer was offered, and they did tell me I would lose the 50,000 Membership Rewards I had been given if I did this because it hadn’t been a full year. Obviously, I changed my mind and did it later.

Citi Application Rules

Citi has cards that offer ThankYou points, another great transferable point option. They also have cards that offer American Airlines miles.

48-month rule

Like the Chase Sapphire Preferred and Reserve cards, Citi has a 48-month rule. The cards that earn ThankYou points and the AAdvantage cards also fall under this rule. However, you can have each of these cards.

Capital One Application Rules

Capital One has become an issuer we like more and more. We have become fans with the addition of transferable partners and the new Capital One Venture X Rewards Credit Card. You can use their miles with transfer partners or in their travel portal and “erase” travel purchases you’ve made on their cards with statement credits. This leads to a lot of versatility in using their miles.

Number of Cards

You can only have two personal cards from Capital One. Additionally, we have found them to be a little stingy with approvals. I applied several times for my Venture One card before I was approved. Recently, I applied for the new Venture X credit card and received a denial despite excellent credit (above 800). My husband, who has the same credit profile and number of cards, was approved. Don’t take it personally if you get a denial from them. They are quirky.

Applications

You must wait 48 months between applications for the Venture, Quicksilver, and Savor cards. Capital One only lets you open one of its credit cards every six months, including personal and business credit cards.

Bank of America Credit Card Rules

Honestly, this is the card issuer I have used the least. It’s not that they’re bad; I find others more compelling. Having said that, I have had my Bank of America Alaska Visa Signature Credit Card for years. I find value in using the companion pass year after year.

Application Timing Rule

You will be approved for a maximum of two credit cards in a two-month period, three credit cards in a twelve-month period, and four credit cards in a 24-month period. This is known as the 2/3/4 rule.

Getting the Card Again

If you have not received the welcome offer in the last 24 months, you can receive it again. My husband canceled his Alaska credit card, and 24 months later, we got the bonus again.

Barclays Credit Card Rules

Barclays has some credit cards worth getting. These include the Hawaiian Airlines credit card, Jet Blue credit card, and some American Airlines credit cards.

General Rules

There is an unofficial 6/24 rule (similar to Chase’s 5/24 rule). In fact, most Barclays rules are pretty unofficial. Barclays may also not approve your application if you have another one of their cards and don’t use it much. To apply for the same card again, you need to cancel the card and wait at least six months.

Bottom Line

Knowing the credit card application rules for the different issuers makes it easier to get approved when you apply for a new card. When you don’t meet the guidelines for one issuer, remember that many cards are available from other issuers. The most important rule is the Chase 5/24 rule, so keep that in mind as you start your points and miles adventure!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.