October 24, 2023

American Express Membership Rewards® Explained

Pam

Once you are over the Chase 5/24, it is time to head off into the world of American Express Membership Rewards®. I recently transferred American Express points to British Airways to travel to London. It was easy to transfer my points and then book a ticket.

American Express offers several credit cards that earn Membership Reward points when you use them for purchases. American Membership Rewards® are similar to Chase Ultimate Rewards®. Here are some things you need to know about American Express Membership Rewards® credit cards.

- One of the most important things to remember about American Express Membership Reward cards is you can usually only get each card once. (Occasionally an offer will be presented without the once-in-a-lifetime rule but that is rare). It is also relatively easy to be approved for these cards. Because of the once-in-a-lifetime rule, make sure you sign up when the offer is high.

- Although many of the cards have an annual fee, this is offset by some pretty amazing rewards and signup bonuses. Most rewards are offered per calendar year, so if you do sign up, you can get them twice by paying one annual fee and then canceling or downgrading the card to a lower or no annual fee card. I think this makes them completely worthwhile. I like the Platinum card so much that it will always be in my wallet. More on that later.

We talk about American Express Membership Rewards® in Podcast #47 Breaking Down AMEX. Listen for more info.

Transfer Partners

Here are the transfer partners you can use with your American Express Membership Rewards®:

- Aer Lingus Air Club

- AeroMexico

- Air Canada Aeroplan

- Air France KLM

- ANA

- Avianca LifeMiles

- British Airways

- Cathay Pacific Asia Miles

- Delta

- Emirates

- Etihad

- Hawaiian

- Iberia

- JetBlue

- Qantas Frequent Flyer

- Singapore

- Virgin Atlantic

- Choice Hotels

- Hilton Hotels

- Marriott Hotels

The Platinum Card® from American Express

This is my personal favorite American Express Card. Yes, it has a high annual fee of $695, but it also has some really great benefits that make up for that high fee. You can read my review of this card here. It lists all the great benefits, too. I think this is a card I will always have in my wallet.

American Express® Gold Card

Another popular card, the American Express® Gold Card has an annual fee of $250 but comes with $120 in dining credits yearly and also $120 in Uber or Uber Eats credits yearly, which basically makes the annual fee $10. You’ll also earn up to $7 in monthly statement credits after you pay with your card at Dunkin’, and up to $100 in statement credits each calendar year ($50 semi-annually) after you pay with your card to dine at U.S. Resy restaurants or make other eligible Resy purchases.

It earns 4x Membership Reward points when paying at restaurants and supermarkets (up to $25,000/yr), so readers can earn a lot of American Express Membership Rewards® on these purchases.

All information about American Express® Gold Card from American Express has been collected independently by Travel Mom Squad. American Express® Gold Card is no longer available through Travel Mom Squad.

American Express has changed their eligibility wording on this card: You may not be eligible to receive a welcome offer if you have or have had this Card, the Premier Rewards Gold Card, the Platinum Card, the Platinum Card from American Express Exclusively for Charles Schwab, the Platinum Card from American Express Exclusively for Morgan Stanley or previous versions of these Cards. You might want to get the Gold card first because of this.

The American Express Gold card gives you 4x on groceries and restaurants which can add up!

American Express® Green Card

I would only get the American Express® Green Card if I wanted to earn more American Express Membership Rewards®, as the $150 annual fee does not justify the welcome offer. It does come with a $100 credit for a Clear membership and a $100 credit for LoungeBuddy passes. Note: Enrollment may be required to receive benefits or credits.

All information about American Express® Green Card from American Express has been collected independently by Travel Mom Squad. American Express® Green Card is no longer available through Travel Mom Squad.

The Business Platinum Card® from American Express

This business credit card has an annual fee of $695, but it comes with a $400 ($200 twice a year) credit from Dell and a $200 airline incidental credit. I use my airline credit with United Airlines to purchase TravelBank certificates. These cards are often offered without the lifetime rule policy. I have gotten more than one of these cards because of this. The Business Platinum Card® from American Express is one that both my husband and I have had.

I use my airline incidental credits for United Travel Bank.

American Express® Business Gold Card

The American Express® Business Gold Card is another good card to get for AMEX Membership Rewards, and the annual fee is $375.I have also received another offer for this card again. It doesn’t have any real benefits that come with the card, so I would only get it if you find a welcome offer of about 90K.

All information about American Express® Business Gold Card from American Express has been collected independently by Travel Mom Squad. American Express® Business Gold Card is no longer available through Travel Mom Squad.

Business Green Rewards Card from American Express

This card is only worthwhile getting if you just need a few extra Membership Rewards. The annual fee is waived the first year.

All information about the Business Green Rewards Card from American Express has been collected independently by Travel Mom Squad. The Business Green Rewares Card from American Express is no longer available through Travel Mom Squad.

The Blue Business® Plus Credit Card from American Express

The Blue Business® Plus Credit Card from American Express occasionally has a higher offer of 50K Membership Rewards. I applied for it once at this offer but I wouldn’t otherwise apply for it unless I really, really needed a few points.

Cancelling Early (after receiving the bonus)

Warning: Be sure to let the annual fee post before you cancel any of these cards after your first year! You have a 30-day grace period to cancel. There have been reports of American Express clawing back (taking away) any points you haven’t used if you cancel the card before this.

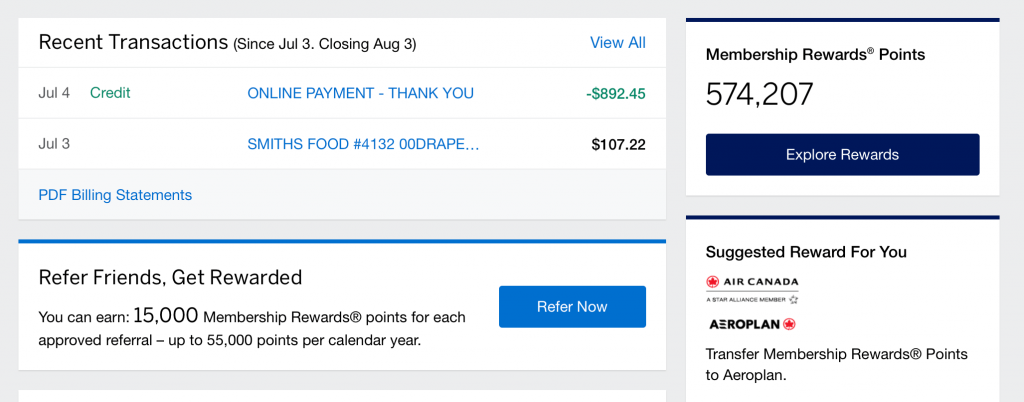

American Express Referral Bonuses

A great way to earn more Membership Rewards is to refer others, including spouses, to your card. This is how to do that. Once you sign in, you will see a screen that looks like this:

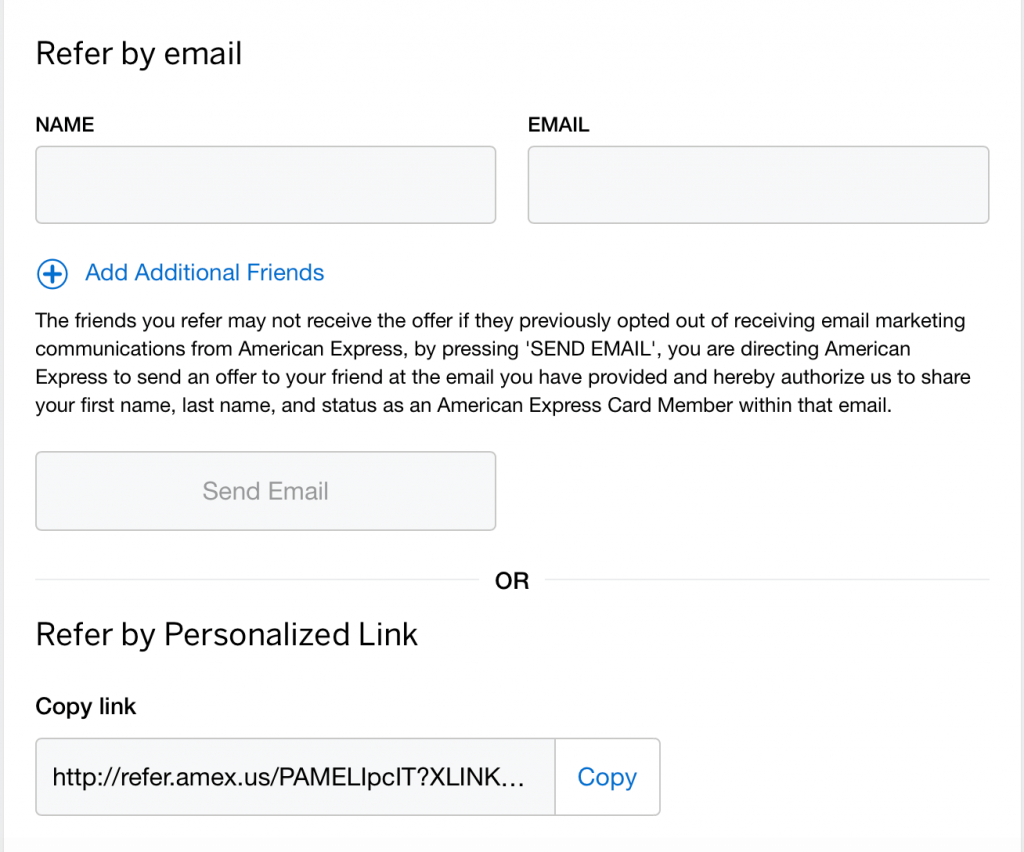

Click on the blue button that says “refer now”. You will get the following screen:

You can refer someone by email or send them a personalized link. You can even post that link on Facebook to entice all your friends to sign up and earn more referral points.

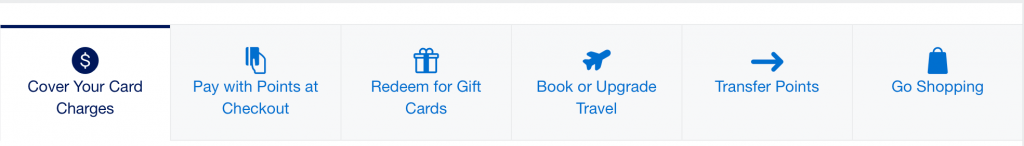

Using American Express Membership Rewards

Here are all the ways you can use your Membership Rewards. You can use your Membership Rewards in many ways. You get the most value when you use them for travel. Don’t fall for the ease of covering your card charges or paying with points at checkout or for gift cards.

We recommend transferring your points to their airline partners to get the best value out of your points. Booking in the AMEX travel portal will get you just .07- 1 cent per points. It can make sense to book in the AMEX portal if you have an AMEX Business Platinum card as that card gets a 35% rebate on flights booked in the portal when you book with your preferred airline or are booking business or first class seat.

Sharing Points

Chase and Citibank let you share points with another account holder. Unfortunately, AMEX does not unless they are an authorized user on one of your accounts. Because I am an authorized user on my husband’s AMEX Gold, he can share or transfer his Membership Rewards to me. Usually, we do not suggest being an authorized user on a spouse’s card. I had canceled my card previously and wanted to use his card for the 4x on groceries and so I became an authorized user. It now works to my benefit for this usage. Keep in mind this will take a 5/24 spot but I was well under 5/24 so went for it.

Expiration Dates

You don’t have to worry about this if you have at least one card that earns Membership Rewards open. I have no plans to close my Gold and Platinum cards, so this is a non-issue for me. We recommend always keeping the AMEX Gold.

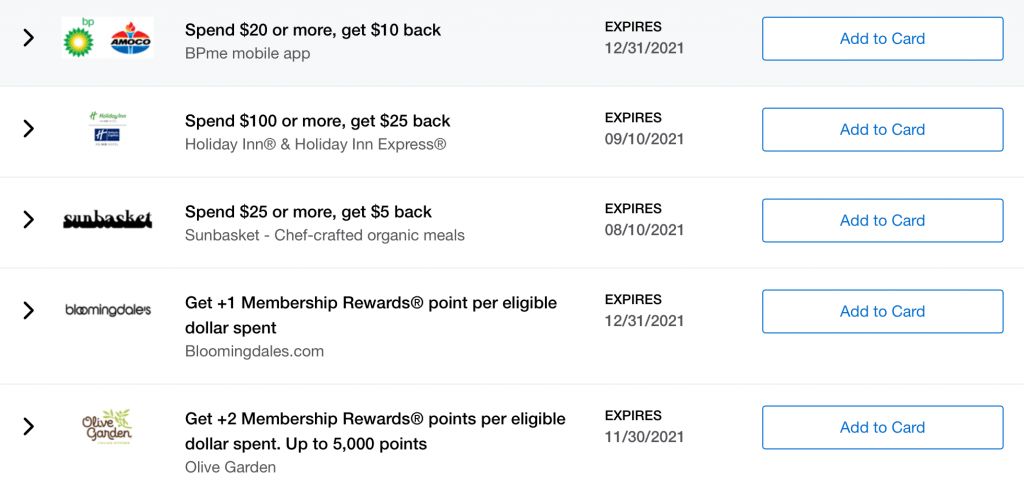

American Express Offers

American Express Offers are offers that are particular to a certain AMEX cards. It may be something like ” save $40 on a $200 Marriott stay” or something similar. You have to add these to your card and then use that card for your purchase. They will then credit you that amount. I have saved a lot of money with these offers, and they are worth checking out. Here’s some of what is currently offered on my Platinum card.

Bottom Line

Once you are over 5/24, I would definitely consider getting Membership Rewards. I think we all agree that Ultimate Rewards are the easiest rewards to use. If you like to travel on the partner airlines listed, like Delta, these cards are definitely for you!

Let us know if you have more questions about Membership Rewards or how to use them. We are always happy to help you through the process!

Related Posts

Podcast #47 Breaking Down AMEX

How to Transfer AMEX Membership Rewards to Airline and Hotel Partners

Review of the American Express Platinum Card

American Express Family Language

What Can You Do with 75K American Express Membership Rewards?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Hi! It has been two years since I opened my gold card. I’m wavering on whether to cancel or not and leaning towards cancelling the card. What happens to my points? Again, I’m not within one year of the sign up bonus, but I have no other AmEx cards. Will I loose the points?

You need to have at least one card that earns Membership Rewards to keep them from expiring.

Thank you so much for the info!