October 24, 2023

American Express Membership Rewards® Explained

Pam

You know we love our flexible points, and American Express Membership Rewards® are no exception. I recently transferred Membership Rewards® to British Airways to travel to London. It was easy to transfer my points and then book a ticket.

American Express offers several credit cards that earn Membership Rewards®. American Express Membership Rewards® are similar to Chase Ultimate Rewards®. Here are some things you need to know about American Express Membership Rewards® credit cards.

- One of the most important things to remember about American Express Membership Rewards® cards is you can usually only earn each welcome offer once. Because of the once-per-lifetime rule, make sure you apply when the welcome offer is high.

- Although many of the cards have an annual fee, it’s typically offset by some pretty amazing rewards and welcome offers. Most benefits are offered per calendar year. I like the Platinum Card® from American Express so much that it will always be in my wallet. More on that later.

We talk about American Express Membership Rewards® in Podcast #47—Breaking Down AMEX. Listen for more info.

Transfer Partners

American Express airline and hotel transfer partners include:

- Aer Lingus

- AeroMexico

- Air Canda

- Air France/KLM

- ANA

- Avianca

- British Airways

- Cathay Pacific

- Delta

- Emirates

- Etihad

- Iberia

- JetBlue

- Qantas

- Qatar

- Singapore

- Virgin Atlantic

- Choice Hotels

- Hilton Hotels

- Marriott Hotels

Not every transfer is 1:1, but many are. Additionally, there are often transfer bonuses so you can earn more miles and points for your Membership Rewards.

card_name

Learn How to Apply

bonus_miles_full

Annual fee: annual_fees

This is my personal favorite American Express Card. Yes, it has a high annual fee , but it also has some really great benefits that make up for that high fee. You can read my review of this card here. It lists all the great benefits, too. I think this is a card I will always have in my wallet.

Apply, and if approved:

- Find out your offer amount

- Accept the Card with your offer

- Spend the required minimum spend in the time required.

- Receive the points

card_name

Learn How to Apply

bonus_miles_full

Annual Fee: annual_fees

You can read our full review of that card here. It has some great benefits to offseet the annual fee.

Apply, and if approved:

- Find out your offer amount

- Accept the Card with your offer

- Complete the minimum spend in the time specified.

- Receive the points

If you are interested in the American Express® Green Card, you will want to apply for that before applying for the card_name American Express now has a specific family language requiring you to get them in a certain order, or you will be locked out of the welcome offer.

card_name gives you 4x on groceries and restaurants, which can add up!

American Express® Green Card

I would only apply for the American Express® Green Card if I wanted to earn more American Express Membership Rewards®, as I find it difficult to offset the annual fee. It does come with up to $209 in statement credits per calendar year after you pay for CLEAR Plus® with your card.

For rates and fees of the American Express® Green Card , see Rates and Fees; terms apply.

All information about American Express® Green Card from American Express has been collected independently by Points TalkSquad. American Express® Green Card is no longer available through Points Talk Squad.

card_name

Learn How to Apply

bonus_miles_full

Annual Fee: annual_fees

See Rates and Fees terms apply.

This business card has a high annual fee, but it also has some really great benefits that make up for that high fee. You can read about the benefits that come with this card here. card_name is one that both my husband and I have had.

card_name

Learn How to Apply

bonus_miles_full

Annual Fee: annual_fees.

See Rates and Fees terms apply.

This is another great option for earning American Express Membership Rewards®. My favorite benefit is earning up to $20 in statement credits monthly when using my card_name for eligible U.S. purchases at FedEx, Grubhub, and office supply stores (enrollment required). I use mine for treats from Grubhub, of course!

card_name

Learn How to Apply

bonus_miles_full

Annual Fee: annual_fees.

I’ve never had this card as the welcome offer is typically not very high. I’d rather get a business card that offers me more points.

American Express Referral Bonuses

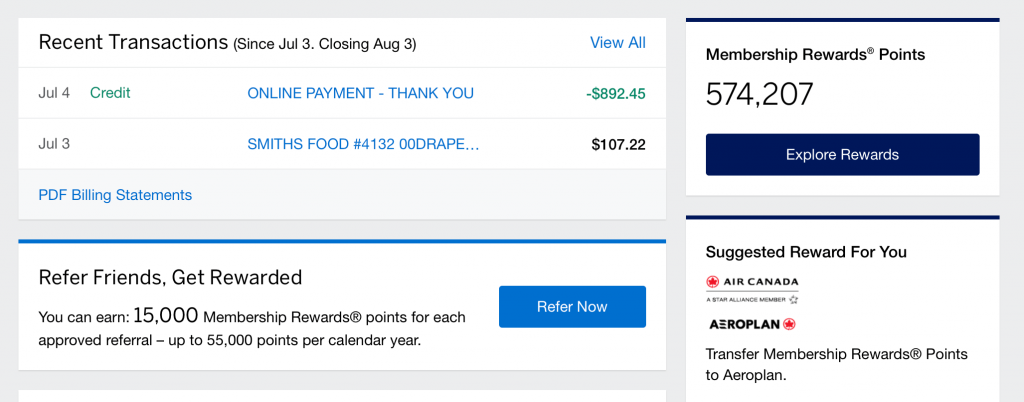

A great way to earn more Membership Rewards® is to refer others, including your spouse, friends, and family members. I love that once you have a card that earns Membership Rewards®, you can often refer for other cards that earn Membership Rewards® (even if it’s a card you don’t currently hold). Here’s how to do that:

- Once you sign in, you will see a screen that looks like this:

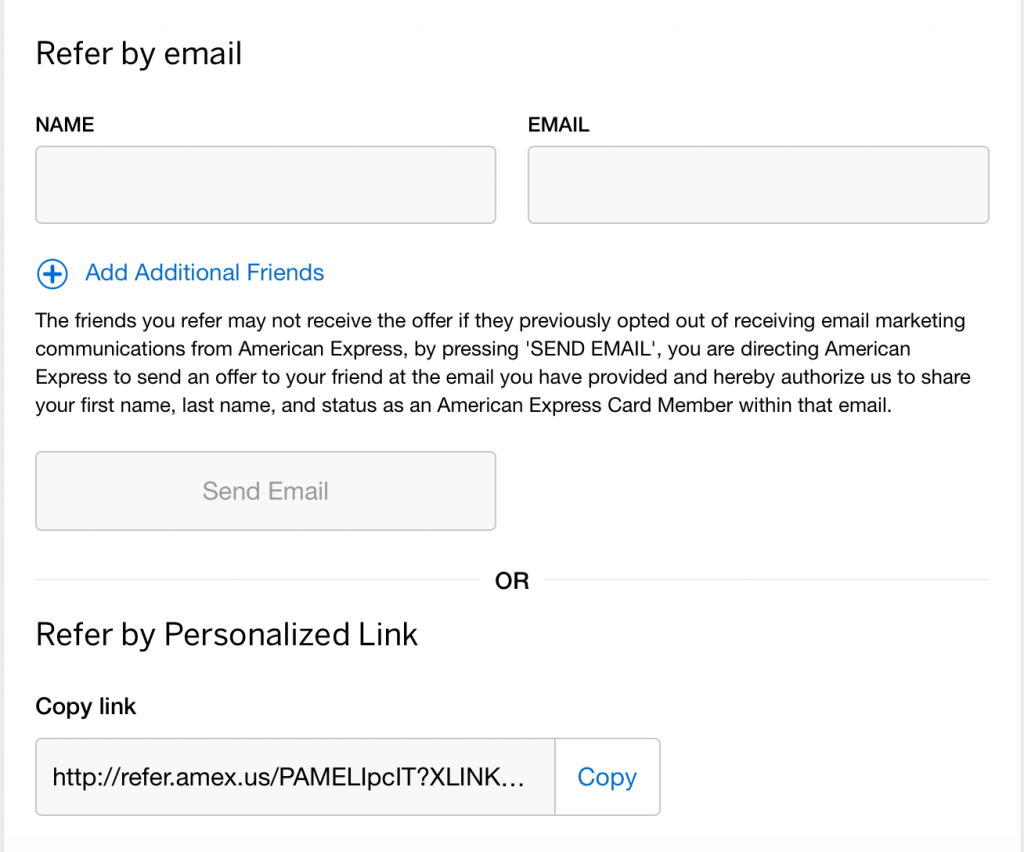

- Click on the blue button that says “refer now.” You will get the following screen:

- You can refer someone by email or send them a personalized link. You can even post that link on Facebook to entice all your friends to sign up and earn more referral points.

Redeeming American Express Membership Rewards®

Here are all the ways you can redeem your Membership Rewards®. You’ll often get the most value from transferring them to partners and booking travel directly with those partners. If you want maximum value, don’t fall for the ease of covering your card charges, paying with points at checkout, or redeeming your points for gift cards.

Sharing Points

Unfortunately, American Express does not allow you to share points with friends or other household members unless they are an authorized user on one of your accounts. An additional card must be issued to the authorized user at least 90 days prior to linking your Membership Rewards® account to that authorized user’s partner program account. Because I am an authorized user on one of my husband’s cards, he can share or transfer his Membership Rewards® to me.

Points Expiration

You don’t have to worry about this if you have at least one card that earns Membership Rewards® open. I have no plans to close my Gold and Platinum Card®, so this is a non-issue for me.

American Express Offers

American Express Offers are offers that are particular to a certain American Express cards. It may be something like, “Save $40 on a $200 Marriott stay” or something similar. You have to add these to your card and then use that card for your purchase. Once you’ve met the requirements of the offer, you’ll earn a statement credit for the amount of the offer. I have saved a lot of money with these offers, and they are worth checking out. Here’s some of what is currently offered on my card_name.

Bottom Line

Membership Rewards® are one of our favorite flexible currencies. We have used these rewards for much of our international travel. If you like to travel on the partner airlines listed, like Delta, these cards are definitely for you!

Let us know if you have more questions about American Express Membership Rewards® or how to use them. We are always happy to help you through the process!

For rates and fees of card_name see Rates and Fees; terms apply.

For rates and fees of the American Express® Gold Card, see Rates and Fees; terms apply.

For rates and fees of the American Express® Green Card , see Rates and Fees; terms apply.

For rates and fees of The Business Platinum Card® from American Express, see Rates and Fees; terms apply.

For rates and fees of The American Express® Business Gold Card, see Rates and Fees; terms apply.

For rates and fees of The Business Green Rewards Card from American Express, see Rates and Fees; terms apply.

Opinions, reviews, analyses, and recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply.

Related Posts

Podcast #47 Breaking Down AMEX

How to Transfer American Express Membership Rewards® to Airline and Hotel Partners

Review of The Platinum Card® from American Express

American Express Family Language

What Can You Do with 75K American Express Membership Rewards®?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Points Talk Squad has partnered with CardRatings for our coverage of credit card products. Points Talk Squad and CardRatings may receive a commission from card issuers when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how or where products appear on this site. Points Talk Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Hi! It has been two years since I opened my gold card. I’m wavering on whether to cancel or not and leaning towards cancelling the card. What happens to my points? Again, I’m not within one year of the sign up bonus, but I have no other AmEx cards. Will I loose the points?

You need to have at least one card that earns Membership Rewards to keep them from expiring.

Thank you so much for the info!