October 28, 2020

American Express® Gold Card Review

Pam

It’s time for a review of the American Express® Gold Card. Unsurprisingly, I am a fan of American Express charge cards. Charge cards differ from credit cards because they require the statement balance to be paid off each month. American Express charge cards are usually easy to be approved for (but require excellent credit), offer Membership Rewards that are transferable points, and have some amazing benefits. Here’s my review of the American Express Gold card.

At least one household member should have this card in their wallet at all times. My husband and I both had it, but after receiving our bonus points and waiting until our annual fee was posted again, we canceled mine. I still use his card all the time, though, mainly for paying for groceries or eating at restaurants. Here are the main reasons it is a card worth keeping.

Membership Points Earned

The top point of my American Express Gold Card review is that you earn 4 points per dollar on groceries and at restaurants. This is up to the first $25,000 spent. I typically spend about $600 monthly on groceries and $200 at restaurants. That means I am spending $9,600 a year in those categories. Multiply that by four, and I get 38,400 Membership Rewards a year – more than enough for a round-trip ticket domestically on Delta (a transfer partner of Amex).

I can also receive 3 points per $1 spent on flights booked directly with the airline or through Amex Travel and 1 point per $1 spent on other purchases. Membership Rewards are generally considered worth between 1 and 5 cents each on average, but it depends on how you use those points. Those 38,000 points I make more than pay for my annual fee ($325) before we even get on to the other benefits.

$120 Dining Credit

The American Express Gold Card gives you a $10 monthly dining credit ($120 annually) when you pay with your card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. I prefer to use my credit at Grubhub as it is easy for me to redeem each month. Enrollment is required.

$120 Uber Credits

There is a $120 Uber credit annually ($10/month) Uber Credit that can be used at Uber Eats as well. I don’t use an Uber often, but I like to eat out. I use my Uber Credit through the Uber Eats app on my phone and get $10 free a month. Just download the app and add your American Express Gold Card information as payment, and each month, you will get a $10 Uber credit. Be sure to pay with that card when you order, and your $10 will be automatically subtracted.

$84 Dunkin’ Credit

If Dunkin’ coffee or donuts are your thing, you can get a $84 Dunkin’ credit annually ($7/month). Enrollment is required.

$100 Resy Credit

A $100 Resy credit ($50 semiannually) is good at certain restaurants internationally. Enrollment is required for this benefit also.

$100 Hotel Credit

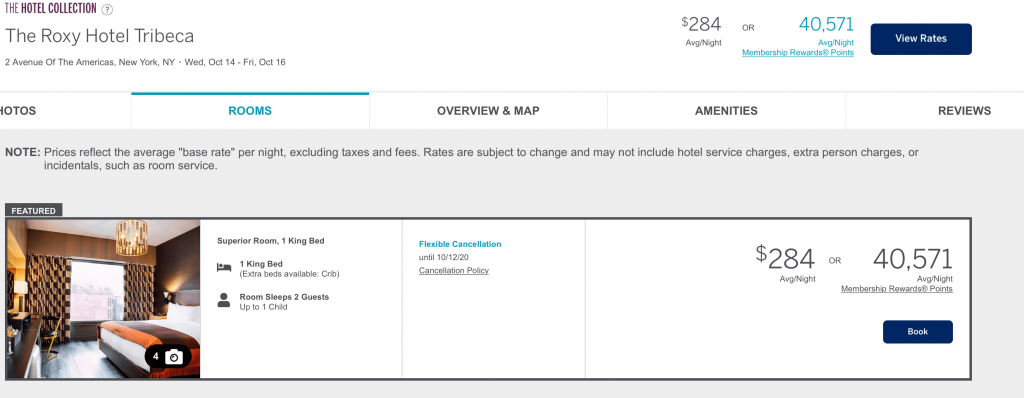

If you book a hotel through the Hotel Collection by American Express and stay at least 2 nights, you will get a $100 hotel credit. I have never taken advantage of this benefit, but I decided to check it out and randomly picked the Roxy Hotel.

If available, you get a room upgrade and a $100 hotel credit for spa or dining. The price excludes taxes and fees. This might be a nice perk if you want to stay in a nice hotel, though!

Redeeming Your Points

The best value for redeeming your Amex points is by transferring them to their airline partners. They also have hotel partners, but using your points for flights is where you will get the most value. Airline partners include Aeromexico, Air Canada, Air France KLM, Alitalia, ANA, Cathay Pacific, British Airways, Delta, Emirates, Etihad, Hawaiian, Iberia, JetBlue, Singapore, Virgin America, and Virgin Atlantic. Hotel partners include Hilton, Choice, and Marriott Hotels. Not every transfer is a 1:1 transfer like Chase Ultimate Rewards, but many are.

Complete List of Benefits

- Earn 4X Membership Rewards(R) points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards(R) points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards(R) points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards(R) points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards(R) point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards(R) points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin’ Credit: With the $84 Dunkin’ Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express(R) Gold Card at U.S. Dunkin’ locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express(R) Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That’s up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express(R) Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Bottom Line

I always use my $120 dining credit and Uber credit, making my $325 annual fee much less. If I were to start using the Resy credit, the annual fee would be worth it. Another tip: when you go out with friends, always pay the bill at a restaurant with this card and let them Venmo you! More points!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.