April 27, 2023

All About Credit Card Authorized Users

Pam

For years, my husband and I ALWAYS applied jointly for each credit card. Both of our names were on each and every card. That worked fine for years. Then I found how to use credit card points and miles, and we quit that for good. Most major credit card issuers don’t even allow joint accounts anymore. But they do allow authorized users. Let’s talk all about credit card-authorized users.

The reason that we advise not adding authorized users is that when you do this, EACH of you takes a Chase 5/24 spot. This means that you will be approved for fewer Chase cards in the long run. You can also have them remove the authorized user, but it’s just easier not even to do it. An authorized user can still get their own card.

To remove an authorized user so that their 5/24 status isn’t affected, do the following:

- Call the number on the back of your card and ask that the authorized user be removed.

- Call all 3 credit bureaus to remove the authorized user account from your report (Equifax, Experian, TransUnion).

You can actually add anyone as an authorized user. Just be careful, as YOU are the one responsible for the payment.

Be careful who you share your credit card with!

Logistics

When someone is added as an authorized user, they get their own card with their own number. That number is just linked to the original user’s account. The primary cardholder is still responsible for all payments. Because any credit card earning of points/miles will be credited to the primary cardholder, there is not a lot of benefit to the authorized user unless they are trying to build credit. In this case, it can help a spouse with a low score or a college-age student to be added as an authorized user.

Occasionally, the primary cardholder may earn extra miles/points for adding an authorized user, but it is usually not a significant amount. For instance, American Express has offered me 10k Membership Rewards to add an authorized user. Not worth it to me to do this for my spouse and have him use a 5/24 spot.

Adding an authorized user can have benefits occasionally. This is true if you hold The Platinum Card® from American Express and can get lounge access, but your spouse can’t. If you don’t want to open another card with a high annual fee, you may justify adding them on as an authorized user (at $195) so you can go into airport lounges together. Taking a family member into a Centurion Lounge would cost you $50/visit, so adding them as an authorized user might make sense if airport lounges are your thing (they are definitely my thing)! You have to do the math and see if that works for you though.

Sharing a Card

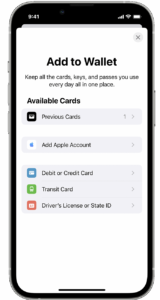

We often hear about people who add their spouse or partner as an authorized user so they can get two cards to make it easier to meet minimum spending. This is not necessary. It is easier for one person to add the card to their “wallet” on their phone. This lets both parties use the card but does not take a 5/24 spot.

Exceptions to the Rule

One of the best lounge access credit cards is card_name, as you can bring in two guests with you to Capital One Lounges, Priority Pass Lounges, and Plaza Premium Lounges. You can add an authorized user for free. If you have a family, it may make sense to add your spouse as an authorized user so that you can bring your entire family into a lounge. Saving on food and beverages for a family can add up and make it worth a 5/24 spot.

Capital One Lounge in Dallas.

Costs for Authorized Users

Costs for authorized users vary per card. Many cards allow you to have free authorized users; some let you have one free authorized user, and others charge you for each authorized user.

Building Credit History

Credit card issuers report to the secondary cardholder’s credit file. Utilization, age of account, and history of repayment are the same for all cardholders on the account, so adding an authorized user can help build a credit history. If the account has been open for a long time and the primary account holder has used it responsibly—including making all payments on time and keeping the balance low relative to the credit limit, it can really help the authorized user increase their credit score.

The age for authorized users varies per credit card issuer, so check with your bank to see how old a child needs to be. This is a fabulous way to start building credit for your child. If the account has been open for a long time and the primary account holder has used it responsibly—including making all payments on time and maintaining a low credit utilization ratio, meaning the balance is low relative to the credit limit—it can benefit a young person.

Adding a teen as an authorized user can help them establish credit.

Bottom Line

You may be tempted to add a spouse or a partner as an authorized user. We don’t ever advise this unless you decide that you want the Venture X card for lounge access for the rest of the family. Otherwise, always apply separately. We want ALL the points we can get, so we want to get those points that our spouses can get. You seriously limit the number of credit cards you can apply for if you are an authorized user on a card, so think twice!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Advertiser Disclosure: Travel Mom Squad has partnered with CardRatings for our coverage of credit card products. Travel Mom Squad and CardRatings may receive a commission from card issuers. This compensation may impact how or where products appear on this site. Travel Mom Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

If we are wanting to transfer points from husband’s Chase Business Preferred card to a World of Hyatt account that has wife’s name on it, what is the easiest way? Chase suggests being an authorized user but is there a different way? In the Rewards portal, it won’t link up the wife’s World of Hyatt account to directly transfer the points there. We use the World of Hyatt account as our family account. Is there a way to have both husband and wife’s name on the World of Hyatt account? Thanks!

Combine your Chase Ultimate Rewards together, then transfer to her Hyatt. Put your Ultimate Ultimate rewards in her account. You cannot have both names on one WOH account but can combine Ultimate Rewards together.

After canceling myself as an authorized user and calling the credit bureaus to remove it from my credit report history, how long should I wait to apply for a card if that was putting me at 5 cards?

I would wait at least 2-4 weeks to make sure it is off.

Any downsides to adding an AU on a biz card? Goal is to improve their credit score.

If you have a personal credit card, you’ll add authorized users, and if you have a business card you’ll add additional employee cards but it will still help their credit score.

Thank you sounds like employee cards would be perfect for this!

As a stay at home mom, I’m an authorized user on all of our credit cards. We have the Chase freedom, United Quest, Sapphire Preferred and World of Hyatt. Is there a process I should follow to cancel myself as an AU and then apply for my own cards? Will I even get approved with no income myself?

Yes, you can be approved – the income you put is household income. As far as removing yourself as AU, you can do that or just apply yourself and if denied, call reconsideration and let them know you are an AU. You’re generally able to remove yourself as an authorized user by calling the credit card issuer and requesting the change.

My husband and I have had a Capital One Venture for many years and he is an authorized user. He just applied for and got a the American Express Hilton card because he stays at Hilton a ton for work. I have two questions:

1. If I want to apply for the Chase Sapphire, should I want a certain amount of time since he applied for his Amex Hilton card, or does it matter?

2. When applying for the Chase card, at what point is the best time to remove him from the Capital One card?

You can apply any time for the Chase Sapphire Preferred – your application times and his don’t matter. I also wouldn’t worry about removing him as authorized user unless he gets a denial at which time you could ask them to reconsider since he is an AU. Or you could call and preemptively ask them to take him off it.

Does the same logic apply for business cards (aka getting them added as an employee)? Since business cards don’t take a 5/24 spot I assume it’s ok on that front, but I do worry that it might make him ineligible to get the SOB for that same card in the future?

He would be applying for a business card in his name or business so that should be okay. However, we’ve never done it – why do you want to add him as an employee?

I just got rejected again for Chase Ink business card. The first time I was told I had too many Chase cards opened in 5/24. So I waited for one to drop off the two years but still got rejected. I’m on my husband’s Chase Sapphire Preferred as an AU. Could that be causing a problem? I have Chase Marriott, Hyatt, IHG, Chase Sapphire Preferred. I have a good credit score and good income.

Yes, definitely. Call the Chase business reconsideration line and tell them you are an AU and have them resubmit it.

I added my husband to all of my cards (ahhh mistake now I am realizing) as an AU. So it seems that I can have him removed and then they will wipe off his credit report and not count towards 5/24?

Yes, I would do that. Additionally, he can just apply and if not approved then you can call reconsideration and explain that he is an AU and they will usually approve him after that. The easiest thing is to just get him removed proactively, in my opinion.

Husband has AMEX and Capital One cards and I have Chase Sapphire….we have had all 3 cards for well over 4 years. I am an authorized user on his and he is on mine. At this point does it even matter for opening new cards? I am about to get on the band wagon of travel hacking! We have over 700k ultimate and 300k capital one points….now trying to figure out the best use for all these points that we have accumulated over the years.

Those cards will not count for your 5/24 anymore. However if you want the welcome offer from the Chase Sapphire again, you need to cancel or downgrade it. Read this post:https://travelmomsquad.com/how-to-downgrade-a-chase-card/

I would also apply for the Capital One cards you don’t have. For instance, if you have the Capital One Venture, Get the Capital One Venture X (or vice versa.

Start planning a fun trip – you have a great amount of points!

I am an authorized user on my husbands CSR but am looking at a credit card specifically to get more points on grocery. I have looked at Amex gold but would like to keep in the UR to not complicate things. Could I get my own CSP to get the 3% on online groceries or is there a better option?

You can absolutely get your own card and get the welcome offer again.

Do I need to cancel my csr as an authorized user?

You can do that or you can apply yourself and then reach out to Chase via the reconsideration line to let them know that you were an authorized user.

I’m still a little confused. My husband has Venture Card and I am AU, if I want to get my own Venture to get the SUB do I first have to remove myself as an AU or can I still apply for my own Venture while being an AU on his? I have been on his for over 2 years so not worried about the 5/24 rule

With a Venture Card, I would apply for the other one that he doesn’t have unless it is a Venture X and you want another one of them for lounge access. In that case, I’d cancel and reapply as they are quirky about approvals anyway and don’t really have a reconsideration line to call.

Hello! Great article! P2 has an AmEx Business Blue Plus. If I’m added as an ’employee’ or authorized user, will this go against me in any 5/24 rules or other rules I’m not aware of? My main goal is to figure out how to use his MR points as I’m the one who plans all of the travel and would prefer to transfer points into my travel partner accounts in order to make the reservations. Thank you!

If it was personal card it would take a 5/24 spot but my husband and I share one personal card and it is nice to manage his points. However, you can also just use his points for travel and book in your name too. That works too. Because this is a business card, it won’t though but you probably will not get the welcome offer in the future for yourself.

Just got the AMEX Gold Business card. Is there any downside to adding my husband as an “employee”? The SUB is so high that I want to be sure he’s using the card every single time he makes a purchase, and feel each of us having a physical card would help with this.

I think if you want him to have a physical card, that would be a good way to go. However, it might preclude him from getting the welcome offer himself in the future.